|

Navigator Benefit Solutions, LLC

Lighting the way to better benefits.

NAVTM Mobile App

MAPP-ing Obama Care |

|

|

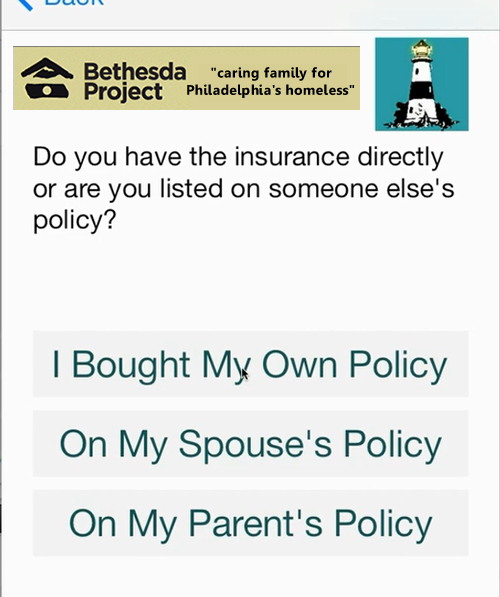

Rejected by Kick*starte*r because a self-help health project. You can still help at idea.me A Birds-eye View of the NAVTM Mobile App: What keeps you awake at night? Loss of a job? Loss of a parent? Loss of a spouse? Have you worked hard for your college degree only to find jobs in your field hard to find? Has your company reduced your hours and you now find yourself to be a part-time employee? Is your company dropping coverage for all its part-time workers? You are a first time health insurance buyer, learning firsthand how costly health insurance can be under the Affordable Care Act. With our project, we seek to complete and release the NAV™ Mobile App which offers the user a simple way for determining whether your health insurance choice meets the requirements of the Affordable Care Act. If any of these events happen, you may also lose health insurance. Or, more likely, will pay a lot more for the coverage; perhaps as much as four to five times (4-5x) more. If you are 40 or under your annual insurance cost may be as much as $2000 more than you would have paid only a few years ago. If you simply cannot afford to continue coverage you’ll be paying more in taxes, perhaps a lot more. For 2014, the tax penalty is the greater of $95 or 1% of your household income. While 1% may not sound like a lot, the numbers can really add up if you are like other Kick*starte*r visitors. More than half of Kick*starte*rs earn over $50,000 (a $500 penalty) and one in ten of you earn over $150,000 (a $1500 tax penalty!). If you live in one of the twenty-five (25) states that decided not to expand Medicaid coverage, you may be experiencing an even bigger surprise. Depending upon your income, all of those promised health insurance purchase subsidies you thought would exist are just not there? If you are a business owner, the picture is not any brighter. Tax penalties can range between $2,000 and $3,000 per employee depending upon whether the employer offers coverage meeting certain requirements. These numbers can really add up.1 Really? How can the additional cost for individuals be that much? Read on and we’ll show you why. But first, let me tell you about our project. Our dream is to raise at least $750 and acquire the technology needed to make the NAV Mobile App available on the Apple App StoreSM. We’ve already purchased the required developer’s license, completed most of the work (as you saw by the video), yet do not have the equipment we need to perform the final tests and pursue the App Store submission. Why so little you ask? The reason is simple, we believe the NAV™ Mobile App will really help people and want to make it available as soon as possible. How We Intend to Put Your Contribution to Work The NAV™ Mobile App is near completion, yet we do not have the technology to perform final acceptance testing and submit the app for inclusion in the App Store. We will put this project to work as follows: $ 750 - Purchase an Apple computer having the required operating system. $ 750-1250 - Purchase an iPhone ($ 400 - 500) to test app on actual equipment rather than just in the simulator. $ > 1250 - We aim to use any money received above $ 1250 to "Light the Way to Better Benefits". Working towards benefits that truly reward individual responsibility and permits you greater control over where any subsidies go. As a start to such control, the NAV™ Mobile App offers its users unique access to charities and the ability to expand your favorite charity’s reach. We expect to start the process by adding a banner ad for select charities. Here is an example of one our favorites:

With significant incentive to complete the work as quickly as possible, we target completing final app submission within two (2) months of purchasing and receiving the equipment. What the Affordable Care Act Requires As stated by the Department of Health and Human Services and the Treasury Department: “Under the Affordable Care Act, the federal government, states, insurers, employers, and individuals share the responsibility to reform and improve the availability, quality, and affordability of health insurance coverage in the United States. Starting in 2014, the individual shared responsibility provision calls for each individual to have health insurance coverage (known as minimum essential coverage), qualify for an exemption, or make a shared responsibility payment when filing a federal income tax return. Individuals will not have to make a shared responsibility payment if coverage is unaffordable, if they spend less than three consecutive months without coverage, or if they qualify for an exemption based on hardship, religious beliefs, or certain other factors.”2 For many of you, such an exemption may well not apply, yet how will you know? What if you recently lost your job recently? What if the coverage you have does not qualify as minimum essential coverage? How will you know whether the coverage does or does not meet the minimum essential coverage requirement? What if you’re eligible for an exemption, how do you qualify? What are the options? Now help me understand, why am I being told to pay so much more under the Affordable Care Act? The Answer - Subsidies and Penalties Subsidies Made Premiums Skyrocket for the Young Much like Forbes’ reporting of a study done by Sector & Sovereign3, health insurance costs with Obama Care soared for those under 40.  The Affordable Care Act limits the rates insurance companies may charge older insureds. Older customers may not pay more than three times (3x) what is paid by a young insured. As such, younger customers pay far more than they did. In effect, insurance for those under 40 includes an extra cost to help subsidize health care for the rest. And based on our firm’s research (outlined above), the extra cost is $1300-1800 a year. Tax Penalties Apply Where Minimum Essential Coverage Is Not Maintained According to healthcare.gov: “The penalty in 2014 is calculated one of 2 ways. You’ll pay whichever of these amounts is higher:

The fee increases every year. In 2015 it’s 2% of income or $325 per person. In 2016 and later years it’s 2.5% of income or $695 per person. After that it is adjusted for inflation. If you’re uninsured for just part of the year, 1/12 of the yearly penalty applies to each month you’re uninsured. If you’re uninsured for less than 3 months, you don’t have a make a payment.”4 For the majority of Kick*starte*r visitors, this tax penalty would likely be $500-2000 in 2014.5 Our Founder and the NAV™ Mobile App Creator What We Offer Our Contributing Friends $1 Tell-A-Friend Special – Each new contributor that contributes at least a $1, tells ten (10) of their friends that also contribute at least $1, and our app submission is accepted to the App Store will receive a NAV™ Mobile App. Each new friend is related directly to only one recommender ( limit of 50 ). $ 100 – Listed as a generous contributor within the NAV™ Mobile App. $ 250 – Recommend a U.S. based, non-profit charity (qualified by the Internal Revenue Service) to include as part of the NAV™ Mobile App Charity Program. If the charity meets IRS standards and agrees to the program, such charity will be included for one-year in the banner ad database used for the NAV™ Mobile App. Top Five Contributors (minimum contribution $500) – Be a beta-tester prior to launch (subject to agreeing and signing a beta-tester license) (limited to 5 testers). Apple, Mac, OS X, and iPhone are trademarks and App Store is a service mark of Apple Inc., registered in the U.S. and other countries 1http://www.newsworks.org/index.php/homepage-feature/item/64159-pa-businesses-will-face-steeper-tax-penalties-without-medicaid-expansion?linktype=hp_impact 2http://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-Sheets/2013-Fact-Sheets-Items/2013-06-26.html 3http://www.forbes.com/sites/matthewherper/2013/12/05/obamacare-raises-health-insurance-costs-especially-for-the-young/ and http://www.sector-sovereign.com/2013/12/higher-premiums-and-higher-deductibles-an-analysis-of-health-plans-on-offer-in-2014/ 4https://www.healthcare.gov/what-if-someone-doesnt-have-health-coverage-in-2014/ 5https://www.quantcast.com/kickstarter.com/summary#!demo |